BMO Global Asset Management is a global asset management business with more than $125 billion in combined discretionary and non-discretionary assets under management as of June 30, 2013On the premise that less risk equals less return, a portfolio of low-risk stocks ought to provide only mediocre performance.

Yet the past few years have seen increased interest in low-volatility investing, which specifically targets low-risk stocks.

Are investors settling for less? Actually, no. According to Dr Ernesto Ramos, head of equities, BMO Global Asset Management, low-volatility stocks can perform just as well as their peers.

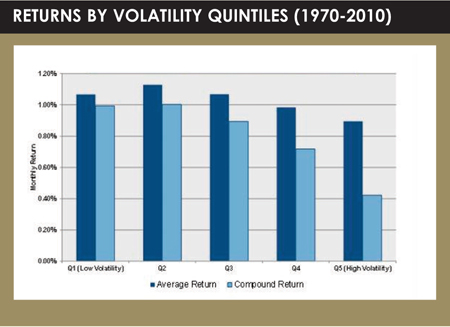

“The following fact is startling: there is no additional return associated with buying higher risk stocks in the long term. This is the low-volatility anomaly.”

Ramos says analysts identified the anomaly in equity markets as long ago as the 1920s, across small and large-cap stocks, developed and emerging markets.

But what causes the anomaly? Researchers have suggested a few theories. One is that benchmark investing encourages investors to buy more higher-risk stocks, which get overvalued.

“The more investors look towards the benchmark as the reference point, the more they are unable to invest in lower-risk stocks, and the more this encourages them to invest in higher-risk stocks.”

Assuming the existence of the low-volatility anomaly, is it reasonable to expect it to hold in future? Ramos says the popularity of passive investing is likely to support the anomaly.

Assuming the existence of the low-volatility anomaly, is it reasonable to expect it to hold in future? Ramos says the popularity of passive investing is likely to support the anomaly.

“The ultimate form of benchmark investing is to invest in passive funds and ETFs [exchange-traded funds]. By doing that, the anomaly is expected to persist, and the more people go to passive investing in benchmark type products, the more we believe it will persist.”

In some market conditions, however, low-volatility strategies underperform other portfolios. This can happen during periods of market reversal, says Ramos, such as in March 2003 or March 2009, when stocks that make the strongest recovery tend to be higher-risk stocks.

With the increased interest in low-volatility investing, is there a risk the trade could become overcrowded? Ramos says the desire to invest for dividends in recent years has bid up the price of low-volatility stocks.

“There was a bit of crowding in low-risk,” he admits.

Active management can help low-volatility investors achieve better returns, however.

Among low-volatility stocks, BMO Asset Management seeks to identify those with the greatest return potential. “We’re trying to be smart not just about the beta, but about the alpha,” he says.

What is the best way to invest in low-volatility strategies? Investors could take some of their equity exposure and allocate it to low-volatility stocks, or they could sell bonds to fund their low-volatility equity investments, which ought to increase returns while keeping risk steady.

“Let’s say you had exposure to the S&P 500 and you take a quarter of that exposure and put it in low vol. The total risk of your equity exposure goes down. If you believe the low-volatility anomaly to be true, you didn’t sacrifice return to do that. You’d expect to end up with a similar return but lower-risk.”

This is not intended to serve as a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. Information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. This publication is prepared for general information only. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized.

Past performance is not necessarily a guide to future performance.

BMO Global Asset Management is the brand name for various affiliated entities of BMO Financial Group that provide trust, custody, securities lending, investment management, and retirement plan services. Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

©2013 funds global mena