Oil companies carry surprisingly little weight in Mena equity markets but the energy sector continues to propel the regional economy. Stefanie Eschenbacher reports.

Oil companies carry surprisingly little weight in Mena equity markets but the energy sector continues to propel the regional economy. Stefanie Eschenbacher reports.

Oil and gas companies represent just a fraction of the stock market in the Middle East and North Africa (Mena), though the energy sector remains a key driver for the regional economy.

With much of the world’s oil wealth concentrated in this region, discussions involving Mena equities have traditionally centered on oil companies and oil prices.

But just how dependent are Mena equity markets on oil companies? And how much of these companies’ returns are driven by oil prices?

Perhaps the most interesting example in this discussion is Saudi Arabia.

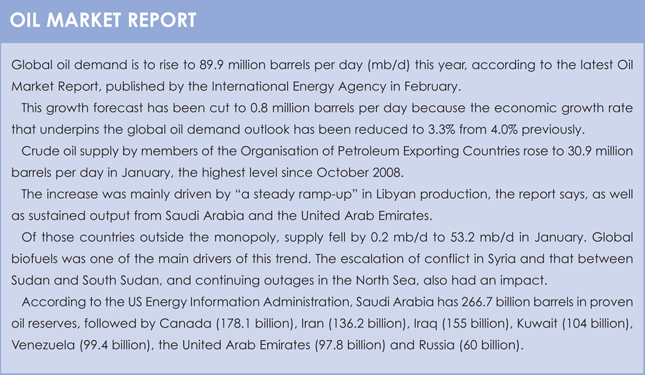

Despite having the world’s largest proven conventional oil reserves, oil and gas companies carry little weight in the country’s stock market.

Saudi Arabia’s total market capitalisation, as measured by the S&P Saudi Arabia BMI, is $341 billion (€258.2 billion), but just 1.87% are energy companies. State-owned oil company Saudi Aramco, for example, is not publicly traded.

Michael Orzano, associate director of global equity indices at S&P Indices, estimates the company has a market value of several trillion dollars.

None of the other countries in the region has significant weightings of oil and gas companies, either.

Many other countries, including Austria and Italy, have a far larger weighting of oil and gas companies in their stock markets.

In Italy, the share of oil and gas companies is 27.49% and in Austria it is 14.15%, according to S&P Indices.

Russia tops the list of countries in which oil and gas companies are publicly traded. The sector accounts for 54.73% of the stock market in Russia, making it the world’s most energy-heavy stock market.

“Contrary to conventional wisdom, the energy industry has little representation in the Mena equity markets,” says Orzano.

This is because the region’s leading oil and gas companies are mostly state-owned and are either not publicly traded or have a low float.

Historical data does not overwhelmingly suggest that the equity markets of those countries belonging to the Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates – are highly driven by energy prices relative to other regions.

Orzano, however, says there is some evidence supporting the notion that the markets are sensitive to energy prices.

A comparative calculation of annual total performance shows the performance of the S&P GCC Composite has been more in line with the S&P GSCI Energy, compared with the S&P Global BMI.

The S&P GSCI Energy, for example, returned 3.44% over one year, 16.21% over three years and 3.52% over five years. Over the same time periods, the S&P GCC Composite lost 0.27%, gained 13.12% and lost 1.39%. Whereas the S&P Global BMI returned 3.35%, 0.8% and 0.18%, respectively.

Mena equity markets appear to be sensitive to energy prices, despite oil and gas companies having little weight in stock markets.

Orzana says energy remains a “crucial driver”, regardless of the low stock market capitalisation of oil and gas companies.

Another set of calculations by S&P Indices aims to measure just how similar the performance of Mena equity markets is to that of energy markets in general and world equity markets.

Correlations between the S&P GCC Composite and S&P Global BMI to the S&P GSCI Energy have been “fairly similar” over time, he says, even though the countries of the GCC have much lower direct exposure to energy stocks.

A comparative analysis of the five-year correlation to the S&P GSCI Energy shows 0.64 to the S&P GCC Composite, 0.63 to the S&P Global BMI, 0.75 to the S&P Russia BMI and 0.72 to the S&P Canada BMI.

“Countries with a preponderance of publicly traded energy companies, such as Russia and Canada, show the highest correlations to energy prices,” Orzano says.

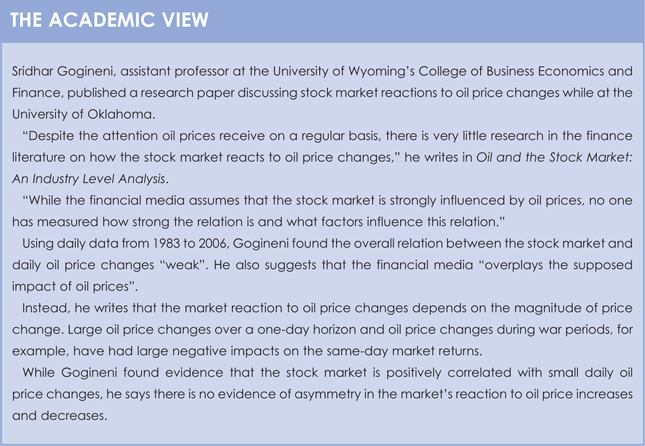

Sridhar Gogineni, assistant professor at the University of Wyoming’s College of Business Economics and Finance, did more indepth research into what exactly influences oil and gas companies.

Overall, Gogineni’s findings suggest that oil companies’ returns depend both on their cost-side dependence and demand-side dependence on oil. The effect of these factors therefore varies across industries.

This means there are few, if any, companies where the performance of their stocks is directly correlated with the oil price. And even if an oil company benefits from a higher oil price, this does not necessarily mean it will pass the gain on to its shareholders.

©2012 funds global