The UAE capital is the seat of the countryâs power and owns a tenth of the world’s oil. Fund managers there are bullish about growth, finds George Mitton.

The UAE capital is the seat of the countryâs power and owns a tenth of the world’s oil. Fund managers there are bullish about growth, finds George Mitton.

Big real estate projects are not unusual in the UAE, where man-made islands, futuristic skyscrapers and the world’s largest shopping malls have all sprung up in the past two decades, but a project in Abu Dhabi could have a large impact on the asset managers who do business there.

The Sowwah Square project is part of the emirate’s 2030 plan and is hoped to become a hub for all finance-related activities. There will soon be an Abu Dhabi Securities Exchange (ADX) building there along with hotels and high-grade office space.

It is unclear if the project will bring a new wave of asset management companies to Abu Dhabi. The authorities do not seem to be planning to emulate the free zone status of the Dubai International Financial Centre, in which companies can be 100% foreign-owned.

But, there are other ways to make the project a success. There are rumours that banks will be required to move their operations to Sowwah Square, thus ensuring the project is populated.

Regardless of whether Sowwah Square brings new companies to the emirate, the project is likely to become a useful meeting place for the companies that are already based in Abu Dhabi. For these firms, the appeal of the emirate is unlikely to diminish soon, for Abu Dhabi has a compelling pair of qualities: money and power.

A COMPARISON

A good way to explain the principle cities of the UAE is like this: Dubai is New York, a fast-moving, entrepreneurial city, while Abu Dhabi is Washington, the capital and seat of political power. But, Abu Dhabi is also Dallas, because Abu Dhabi has a tenth of the world’s oil.

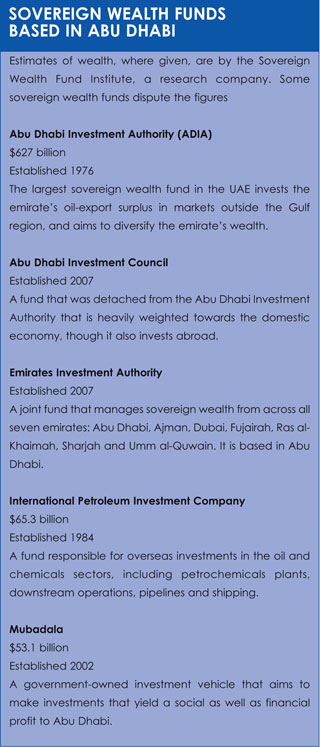

Asset managers based in Abu Dhabi are there to service this oil wealth, principally that of the numerous sovereign wealth funds (see box). Some asset managers also serve the high-net-worth individuals in Abu Dhabi who like to do their private banking close to home.

“For our clients, it’s important for us to be in Abu Dhabi,” says Karine Kheirallah of Falcon Private Bank in Funds Global’s roundtable, (see next pages). “There is a lot of wealth out here. You have to be close to your clients and show that you have a presence here.”

Although Dubai is only two hours away by road, it is often an advantage to be in the same city as clients, she says. Other executives say it is useful to be in Abu Dhabi for after-hours meetings or for networking opportunities.

Another participant on the roundtable, Firas Mallah, Mena managing director at Bank of Montreal Asset Management, says his company considered setting up an office in Dubai before choosing Abu Dhabi.

“The paperwork is probably easier in Dubai, but we were more comfortable with Abu Dhabi’s approach to long-term planning,” he says.

It seems that after a rocky few years, asset managers may now be able to make some money in the region. The stock market of Abu Dhabi has performed well in recent months. In the first month and a half of 2013, the Abu Dhabi Securities Market General Index rose 12%. Bloomberg consensus estimates predict a market gain of 19% for the year with a 5% dividend yield, which would put Abu Dhabi on a par with some of the best-performing markets in the world.

It seems that after a rocky few years, asset managers may now be able to make some money in the region. The stock market of Abu Dhabi has performed well in recent months. In the first month and a half of 2013, the Abu Dhabi Securities Market General Index rose 12%. Bloomberg consensus estimates predict a market gain of 19% for the year with a 5% dividend yield, which would put Abu Dhabi on a par with some of the best-performing markets in the world.

GROWTH PROSPECTS

Fund managers see promising signs to support this optimism. At the start of the year, Abu Dhabi’s two largest real estate companies, Aldar Properties and Sorouh Real Estate, completed a merger. This shows a recognition of the need for consolidation, says Mark Friedenthal, head of capital market solutions at Abu Dhabi Commercial Bank (ADCB). This is a sign that the market has learned lessons from the financial crisis, he says.

Of course, the stock market does not reflect the true economy, a common feature of Gulf countries. The oil industry, for instance, is state-owned and the prospect of it being listed is slim. According to ADCB figures, the oil industry accounts for 60% of Abu Dhabi’s economy but only 4% of the market capitalisation of the Abu Dhabi index. Another anomaly is that financial services, which makes up 5% of GDP, account for nearly half of market capitalisation, according to the same figures.

But such anomalies are not a reason to avoid the stock market. The banks in Abu Dhabi are a particularly good bet, says Friedenthal. They are among “the cheapest in the world”, he says. Even though they are strongly capitalised and, in many cases, have the backing of the oil-rich Abu Dhabi government, the banks have not yet attracted high valuations.

However, property prices in Abu Dhabi, that familiar barometer of economic performance, show a mixed picture. Rents in quality buildings in desirable locations, such as Al Raha Beach, Saadiyat Island and prime residences on the Corniche, rose in the last quarter of 2012, according to property consultancy CBRE. But rents in older apartments and offices in the city centre fell between 2% and 4% in the same period.

“It’s still too early to talk of a [real estate] recovery,” says Friedenthal. “We’re seeing some early signs of improvement in Dubai but we may still have a bit of a supply overhang here in Abu Dhabi.”

Alan Durrant, chief investment officer at National Bank of Abu Dhabi, says it is essential to see the property markets in the two main cities of the UAE as linked. “It’s impossible to divorce Dubai and Abu Dhabi.”

He adds that spending habits in the two cities are linked, too. Many high-net-worth individuals in Abu Dhabi own property in Dubai and have seen their fortunes rise and fall with Dubai’s volatile property market.

Even if they do not own property directly, these same investors may be exposed to the Dubai property market by owning shares in real estate companies such as Emaar.

In addition, the ability of banks in Abu Dhabi to loosen lending depends on the resolution of non-performing loans related to real estate in Dubai.

But the good news is that as Dubai’s property prices rise again, Abu Dhabi investors gain a windfall, even if prices at home do not rise as fast.

©2013 funds global MENA