Islamic investing has been around for a number of decades, and in recent years this market has seen significant growth.

Islamic investing has been around for a number of decades, and in recent years this market has seen significant growth.

The Middle East and Malaysia in particular have experienced a surge in demand for high-quality Islamic investment products. Before discussing why Pyrford entered this market, we should define what is meant by Shariah-compliant investing.

According to Islamic principles, Muslims can only invest in “halal” (permissible) instruments and avoid “haram” (non-permissible) investments. The selection of stocks within a Shariah-compliant fund must adhere to certain principles. First, there are qualitative criteria – the fund cannot invest in companies whose primary business activity is in haram industries; for instance gambling or alcohol. There are also quantitative criteria (agreed with a Shariah board) – for example, the fund cannot invest in companies that generate their earnings using inappropriate financial resources; either through excessive leverage, or excessive cash.

At Pyrford, we started looking at Islamic funds in 2006 (having managed “conventional” funds since 1987), and gained our first Shariah-compliant investor soon after. What attracted us to this market was the similarity between Islamic investing and Pyrford’s own “conventional” approach; both espouse a long-term view of investing and view investing in shares as a part-ownership of the business. This fits in with the Islamic finance model of risk and profit sharing.

At Pyrford, we started looking at Islamic funds in 2006 (having managed “conventional” funds since 1987), and gained our first Shariah-compliant investor soon after. What attracted us to this market was the similarity between Islamic investing and Pyrford’s own “conventional” approach; both espouse a long-term view of investing and view investing in shares as a part-ownership of the business. This fits in with the Islamic finance model of risk and profit sharing.

Pyrford’s “conventional” approach shows an aversion to investing in highly leveraged companies (companies with excessively high debt levels), again a very “Islamic” concept; in Islam, money is merely a means to an objective and not the objective itself. We look to remove companies that artificially boost their returns through increasing leverage, and favour companies that achieve high returns through improvements in profit margins or operating efficiencies, which we view as superior sources of return. Such a conservative approach has a high degree of overlap with Islamic investing and so it was a natural progression for Pyrford to establish a range of Shariah-compliant funds to meet the needs of Muslim investors around the world.

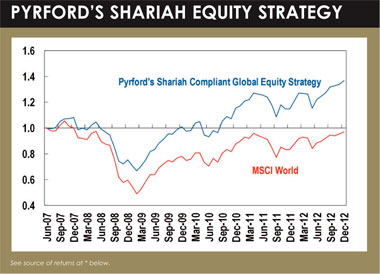

A common misconception we hear is that by restricting the universe of available stocks, Islamic investors are putting themselves at a disadvantage versus conventional investors. Nothing could be further from the truth. The DJ Islamic US Market Index has comfortably outperformed the S&P 500 since 1996 (the longest data range available). The reason for this? The Islamic index does not include highly leveraged companies that have recklessly boosted their returns through excessive debt, like banks and insurance companies, and so suffered catastrophic meltdowns in 2008 and 2009.

As investors realise that the returns from taking longer term positions in companies with solid balance sheets that are conservatively managed are greater than the returns on offer from shorter term trading, we believe this market will continue to show strong growth.

This article was written by Nabil Irfan, Portfolio Manager and Suhail Arain, Head of Portfolio Management North America at Pyrford International. Pyrford international is part of the BMO Global Asset Management family. For further information please contact Firas Mallah, Managing Director, BMO GAM Abu Dhabi at [email protected], +97126594254.

* Source of returns

1. From 01/07/2007 – 29/02/2008: Global Equity carve-out of a Global Balanced portfolio, gross of fees, with a further screen for shariah compliance.

2. From 01/03/2008 – 30/11/2011: A model portfolio based on shariah compliant securities.**

3. From 01/12/2011: An actual shariah compliant Global Equity Fund.

The date of inception is 1 July 2007.

Benchmark source: © CME Group Index Services, LLC 2011. All rights reserved.

** Model results do not represent actual trading and may not reflect the impact of material economic and market factors. Past performance does not guarantee future results.