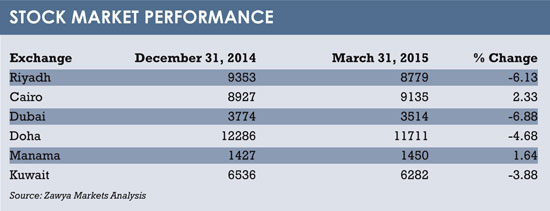

Weak oil prices weighed on the main Gulf stock markets during the first quarter of the year, but Egyptâs market rallied after a conference pledged tens of billions of dollars of investment for the country.

Weak oil prices weighed on the main Gulf stock markets during the first quarter of the year, but Egyptâs market rallied after a conference pledged tens of billions of dollars of investment for the country.

Dubai’s index dropped nearly 7% in the first three months of 2015 due to slower corporate profit growth and a shift in investor attention to Saudi Arabia, which plans to open its market to direct foreign investment in the second half of the year.

The Saudi market, the Arab world’s largest, had outperformed the region, but it fell as oil prices declined, hampering the outlook for the petrochemicals sector. Banks also pulled back following a regulatory cap on consumer finance fees introduced in the kingdom last year. Meanwhile, approval of a land tax plan led to a sell-off in the property sector in late March. By the end of the quarter, the Saudi main stock index had fallen 6%.

Egypt and Bahrain bucked the negative trend in the first quarter, with Cairo’s stock market gaining 2.3% and Bahrain’s rising 1.6%. On the Egyptian market, property stocks performed strongly after the government announced plans to build a new capital city and ease a housing shortage.

SAUDI HYPE

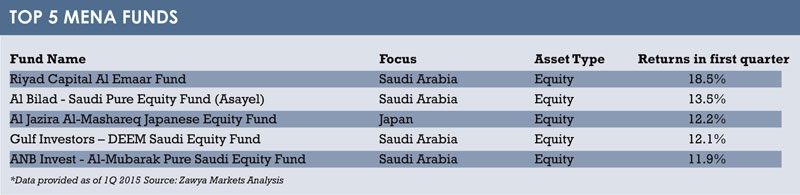

Funds are closely watching Saudi Arabia ahead of the opening of its $601 billion stock market to foreign institutional investors on June 15.

Indeed, Saudi-focused funds were the best performers in the first quarter. The top five funds in the MENA market were either domiciled in or focused on Saudi Arabia, and they returned between 11.9% and 18.5%.

Indeed, Saudi-focused funds were the best performers in the first quarter. The top five funds in the MENA market were either domiciled in or focused on Saudi Arabia, and they returned between 11.9% and 18.5%.

However, reports suggest that, by imposing strict foreign ownership limits, Saudi regulators are trying to avoid a deluge of foreign money.

In addition, any inclusion of Riyadh’s exchange in the MSCI emerging market index is at least two years away.

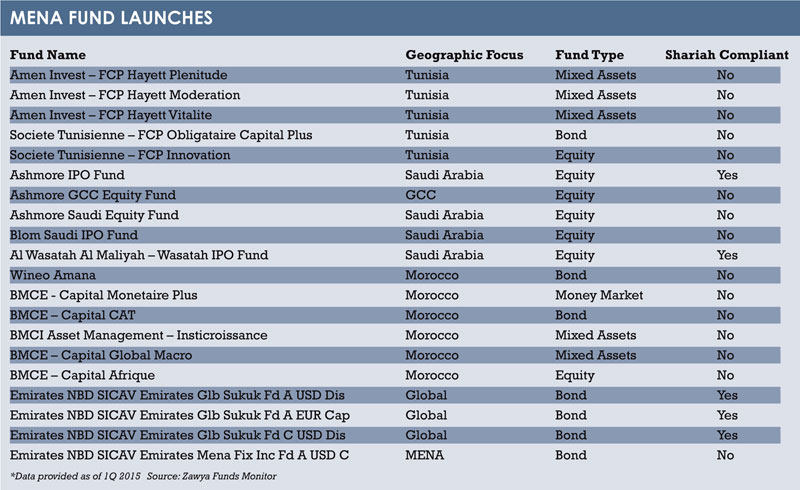

In the wider MENA region, 20 mutual funds were launched during the first three months of the year, mostly focused on Tunisia, Morocco and Saudi Arabia. Bonds and equities were the preferred asset classes. Fifteen of the launched funds were conventional and only five were sharia-compliant.

LACK OF LISTINGS

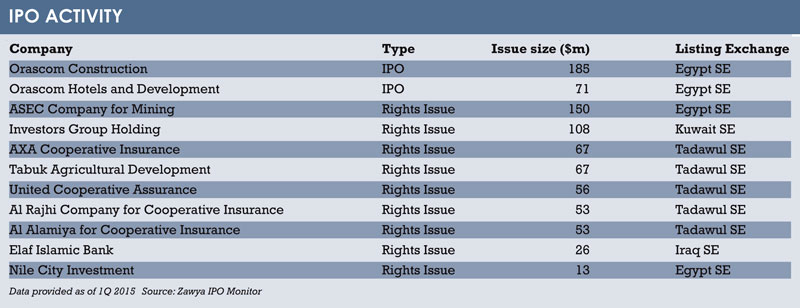

Weaker oil prices dampened initial public offering (IPO) activity in the region, with many companies either postponing or cancelling their listing plans due to volatility on many Arab markets, where investor sentiment can often overshadow financial fundamentals.

Only two IPOs took place in the first quarter of 2015, both in Egypt. They raised combined capital of $256 million.

New regulations in the UAE that reduce the minimum free float for an IPO from 55% to 30% could encourage more listings.

©2015 funds global mena