From hospitals and schools to railways and power plants, infrastructure plans in the Middle East are huge. Investors want to participate in this growth, but what’s the best way to do it? George Mitton reports.

From hospitals and schools to railways and power plants, infrastructure plans in the Middle East are huge. Investors want to participate in this growth, but what’s the best way to do it? George Mitton reports.

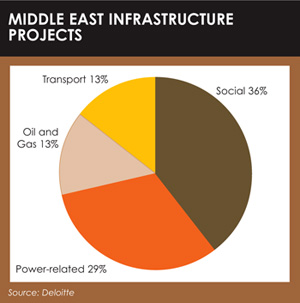

Long-term infrastructure projects in the Middle East are expected to be worth in excess of $1 trillion, according to professional services firm Deloitte. This figure may rise as governments reassess their priorities in the wake of the Arab Spring. “The uprisings have been credited with positively influencing infrastructure investment, forcing governments to accelerate spending programmes in order to meet citizens’ higher expectations,” says Deloitte.

The chart on the right gives Deloitte’s estimates as to where this funding will go. The largest chunk goes to “social” projects, a category including, among others, projects in the healthcare and education sectors.

Many investors have wondered how they can gain exposure to this growth. In the Gulf Cooperation Council (GCC), where much of the infrastructure is destined, projects have traditionally been financed by state wealth, derived from oil and gas, or by bank financing. This does not leave room for private investors.

Many investors have wondered how they can gain exposure to this growth. In the Gulf Cooperation Council (GCC), where much of the infrastructure is destined, projects have traditionally been financed by state wealth, derived from oil and gas, or by bank financing. This does not leave room for private investors.

However, some believe private investors will play a bigger role in future.

GROWING OPPORTUNITIES

“Coming to the capital markets is a must. We are going to need them to develop the infrastructure that’s required,” says Salah Shamma, co-head of Mena equities at Franklin Templeton, Middle East. “The banking sector can’t do it by itself.”

It seems some family offices and ultra-high-net-worth investors in the Gulf are waking up to the opportunity offered by investments in infrastructure. MEFIC Capital, a Riyadh-based asset and wealth management firm, advises its clients to invest 15% of their portfolios in private equity projects related to healthcare and education in Saudi Arabia (see page 28-29).

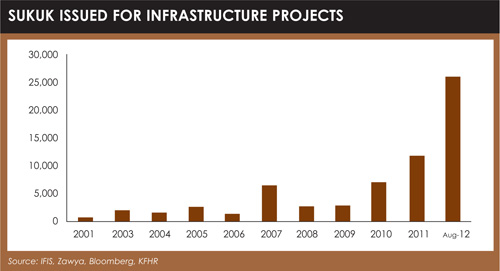

Another promising option is to buy debt issued by infrastructure developers. According to figures from Kuwait Finance House, the volume of Islamic bonds, sukuk, issued for infrastructure projects in 2012 up to August was roughly double that of 2011. About three-quarters of issuance was in Malaysia, which has the most developed sukuk market. But GCC entities are catching up, with Saudi Arabia playing a leading role.

However, in parts of the Mena region, growth of infrastructure investment is limited by the legal framework. Lynette Brown, partner at law firm Al Tamimi, Dubai, says under UAE law it is difficult to take security from future income streams; the law does not recognise taking security from something that does not yet exist. Exceptions may include a power plant that has off-take agreements with future clients already in place, though these agreements may have to specify precise quantities, which are not always possible to predict.

However, in parts of the Mena region, growth of infrastructure investment is limited by the legal framework. Lynette Brown, partner at law firm Al Tamimi, Dubai, says under UAE law it is difficult to take security from future income streams; the law does not recognise taking security from something that does not yet exist. Exceptions may include a power plant that has off-take agreements with future clients already in place, though these agreements may have to specify precise quantities, which are not always possible to predict.

“The laws need to catch up,” she says.

HURDLES

Another option is to gain exposure to infrastructure through the equity markets. Companies that supply building materials will benefit from the building boom, as will banks that provide financing. Contractors themselves also seem an obvious choice. However some fund managers warn of significant overcapacity in the industry.

The biggest hurdle to infrastructure investment may simply be the region’s wealth. Governments of oil-producing countries continue to be well funded thanks to consistent oil prices, and lack a strong incentive to structure markets so that private investors play a role. It may be that those states without large budget surpluses lead the way in promoting private investment. Within the UAE, an emirate such as Sharjah may have a more pressing need to court private investors than Abu Dhabi.

©2012 funds global mena